Application conditions for a car loan from Guangfa Bank: citizens of the People's Republic of China, or Hong Kong, Macao and Taiwan residents and foreigners who have lived in the People's Republic of China for more than one year (including one year); the age stage is 18 to 60 years old, and the total age of the borrower and the loan term shall not exceed 65 years; have valid identity certificate and local permanent residence certificate.

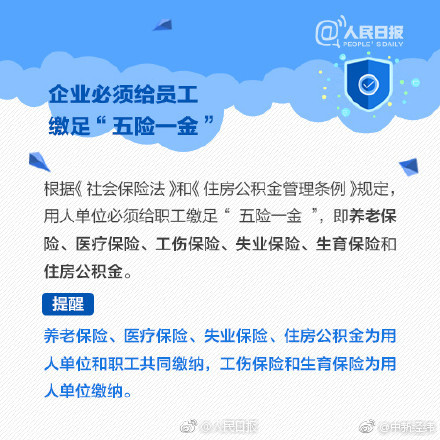

What are the conditions for Guangfa Bank loan? Guangfa Bank loan application conditions? Applicants need to be at least 25-55 years old. Applicants need to have a record of paying social security or provident fund or personal tax for more than three months.The applicant has a fixed job and a stable economic income. The applicant agrees to other regulations of Guangfa Bank.

First of all, you need to submit the relevant application for a car loan with Guangfa credit card. At this time, you need to be optimistic about the vehicle you want to buy. Fill in the car consumer loan application form and the credit status questionnaire, and submit it to the lending bank together with the relevant certificates of personal information. Investigation and approval. The bank conducts pre-loan investigation and approval.

1. Apply. After being optimistic about the vehicle to be purchased, fill in the application form for car consumer loan and the credit situation questionnaire, and submit it to the lending bank together with the relevant proof of personal information. The bank conducts pre-loan investigation and approval.

2. China Merchants Bank loan car purchase process Users choose their favorite vehicle, fill in and submit the China Merchants Bank car purchase application intention form. After the application is approved, prepare relevant personal information and other materials. After the loan is approved, pay the down payment, purchase insurance and apply for license plate, and successfully complete the loan and car purchase.

3. What is the process of buying a car in installments and 4s stores with China Merchants Credit Card? Buyer and buyerPeople negotiate, reach an agreement on the purchase and sale, pay the first installment of the car purchase, sign a mortgage contract with the bank, go to the vehicle management department for registration and issuance of license plates, and go through the registration procedures at the same time. The bank issues loans to buyers.

4. China Merchants Bank's car loan processing process: the first step: the loan applicant submits the application; waits for the bank's approval; the second step: China Merchants Bank loans to pick up the car. The interest rate of China Merchants Bank loan to buy a car: Apply for a China Merchants Bank car loan, and the loan interest rate is related to the applicant's personal situation.

5. China Merchants Bank credit card car installment process: check the car installment amount, I have 220,000 yuan here. Inquire about the rate, the standard handling fee rate of China Merchants Bank's car installment business is 5% for 12 installments, 5% for 24 installments, and 15% for 36 installments.

6. Sign a loan agreement with the borrower;The bank allocates the money to the car dealer account; the cardholder handles procedures such as car mortgage registration; the cardholder picks up the car and uses it.

1. The car can be mortgaged. A car mortgage is a loan obtained from a financial institution or a car consumer loan company with the car or self-purchased car of the borrower or a third party as collateral.

2. Every bank can apply for car mortgages, of course, including CCB, Agricultural Bank of China, Bank of China, etc., but when different banks use cars for mortgages, the conditions for applying for or mortgage are different. Let's talk about the car mortgage of Shanghai Bank as a case.

3. Yes, banks can make vehicle mortgages.It should be noted that different banks may have different requirements for vehicle mortgages, and the specific conditions should be subject to the consulting bank.

4. Which bank can apply for a vehicle mortgage? Most banks can do car mortgages, such as China Construction Bank, Industrial and Commercial Bank of China, Agricultural Bank of China, etc. As long as users meet the loan conditions, they can directly apply for a vehicle mortgage. As for whether it can pass the audit, the audit results of the bank shall prevail.

1. If you apply for a personal consumer car loan at the Bank of China, the borrower needs to meet the following conditions 1 A natural person with full civil capacity 2 Personal identity is validProof 3 Have sufficient legal ability to repay the principal and interest of the loan 4 Good personal credit 5 Hold a car purchase contract agreement approved by the handling bank.

2. Current requirements for bank car loans: age requirements: applicants must be at least 18 years old, men must not be over 65 years old, and women must not be over 60 years old. Job requirements: At present, the applicant has a stable job and income, and the monthly repayment amount of the car loan cannot exceed 50% of the monthly income.

3. Bank of China's personal consumer car loan application materials: loan application (need to include the borrower's name, address and valid contact information and other information). The borrower's valid identity proof materials, married customers need to provide spouse's identity proof materials and marital status proof materials at the same time. Borrower's income/asset certification materials.

4. (5) The car buyer is willing to accept other conditions that the bank deems necessary.

5. Certificate of ability to pay the first purchase of the limit stipulated in these measures; other conditions stipulated by the bank.

CCB's interest rate is 6% per year, and the interest rate for one to five years is 0%. The monthly payment calculation is your loan amount divided by the loan term, and the term is yes Calculated by month.

CCB car mortgage loan interest rate CCB car loan interest rate is as follows: 1. The interest rate on car loans of one year or less is 6%, and the interest rate of car loans of more than one year but not more than five years is 6%; calculate once. If the applicant chooses to borrow for three years, the loan amount is 150,000 yuan.

The current benchmark interest rate for commercial loans is 35% within one year, 75% for one to five years, and 9% for more than five years.

It is understood that the three-year interest rate of the Construction Bank's car loan is normal during this period. The interest is closely related to the loan amount. Interest = the annual interest rate of the loan amount is 3. The overall loan interest rate is mainly subject to the provisions of the Construction Bank's loan interest rate.

The loan interest rate of car loans is generally between 5% and 3%. The following is a relevant introduction to the car loan interest rates of each bank: Bank of China: the loan term is 1 year, the loan interest rate is 4%, the loan interest rate is 8% for 2 years, and the interest rate is 12% for 3 years.

If you apply for a medium- and long-term loan in CCB, the loan interest rate is 75% for three to five years (including five years). Most people go to CCB to apply for a car loan, and the maximum repayment period can only be three years. That is to say, if the user goes to CCB to apply for a car loan, the loan interest rate is about 35%-75%.

Basic banks can apply for car mortgages, such as Bank of China, Industrial and Commercial Bank of China, etc., but the relative mortgage is different.

Which bank can make car mortgages? At present, Agricultural Bank of China, China Construction Bank, Industrial and Commercial Bank of China, etc. can make car mortgages. Take the Agricultural Bank of China as an example, the specific conditions for its processing are: the applicant must be between 18 (inclusive) and 60 (inclusive) years old and have full civil capacity.

Every bank can apply for car mortgages, of course, including CCB, Agricultural Bank of China, Bank of China, etc., but when different banks use cars for mortgages, the conditions for application or mortgage are different.Let's talk about the car mortgage of Shanghai Bank as a case.

How to access historical shipment records-APP, download it now, new users will receive a novice gift pack.

Application conditions for a car loan from Guangfa Bank: citizens of the People's Republic of China, or Hong Kong, Macao and Taiwan residents and foreigners who have lived in the People's Republic of China for more than one year (including one year); the age stage is 18 to 60 years old, and the total age of the borrower and the loan term shall not exceed 65 years; have valid identity certificate and local permanent residence certificate.

What are the conditions for Guangfa Bank loan? Guangfa Bank loan application conditions? Applicants need to be at least 25-55 years old. Applicants need to have a record of paying social security or provident fund or personal tax for more than three months.The applicant has a fixed job and a stable economic income. The applicant agrees to other regulations of Guangfa Bank.

First of all, you need to submit the relevant application for a car loan with Guangfa credit card. At this time, you need to be optimistic about the vehicle you want to buy. Fill in the car consumer loan application form and the credit status questionnaire, and submit it to the lending bank together with the relevant certificates of personal information. Investigation and approval. The bank conducts pre-loan investigation and approval.

1. Apply. After being optimistic about the vehicle to be purchased, fill in the application form for car consumer loan and the credit situation questionnaire, and submit it to the lending bank together with the relevant proof of personal information. The bank conducts pre-loan investigation and approval.

2. China Merchants Bank loan car purchase process Users choose their favorite vehicle, fill in and submit the China Merchants Bank car purchase application intention form. After the application is approved, prepare relevant personal information and other materials. After the loan is approved, pay the down payment, purchase insurance and apply for license plate, and successfully complete the loan and car purchase.

3. What is the process of buying a car in installments and 4s stores with China Merchants Credit Card? Buyer and buyerPeople negotiate, reach an agreement on the purchase and sale, pay the first installment of the car purchase, sign a mortgage contract with the bank, go to the vehicle management department for registration and issuance of license plates, and go through the registration procedures at the same time. The bank issues loans to buyers.

4. China Merchants Bank's car loan processing process: the first step: the loan applicant submits the application; waits for the bank's approval; the second step: China Merchants Bank loans to pick up the car. The interest rate of China Merchants Bank loan to buy a car: Apply for a China Merchants Bank car loan, and the loan interest rate is related to the applicant's personal situation.

5. China Merchants Bank credit card car installment process: check the car installment amount, I have 220,000 yuan here. Inquire about the rate, the standard handling fee rate of China Merchants Bank's car installment business is 5% for 12 installments, 5% for 24 installments, and 15% for 36 installments.

6. Sign a loan agreement with the borrower;The bank allocates the money to the car dealer account; the cardholder handles procedures such as car mortgage registration; the cardholder picks up the car and uses it.

1. The car can be mortgaged. A car mortgage is a loan obtained from a financial institution or a car consumer loan company with the car or self-purchased car of the borrower or a third party as collateral.

2. Every bank can apply for car mortgages, of course, including CCB, Agricultural Bank of China, Bank of China, etc., but when different banks use cars for mortgages, the conditions for applying for or mortgage are different. Let's talk about the car mortgage of Shanghai Bank as a case.

3. Yes, banks can make vehicle mortgages.It should be noted that different banks may have different requirements for vehicle mortgages, and the specific conditions should be subject to the consulting bank.

4. Which bank can apply for a vehicle mortgage? Most banks can do car mortgages, such as China Construction Bank, Industrial and Commercial Bank of China, Agricultural Bank of China, etc. As long as users meet the loan conditions, they can directly apply for a vehicle mortgage. As for whether it can pass the audit, the audit results of the bank shall prevail.

1. If you apply for a personal consumer car loan at the Bank of China, the borrower needs to meet the following conditions 1 A natural person with full civil capacity 2 Personal identity is validProof 3 Have sufficient legal ability to repay the principal and interest of the loan 4 Good personal credit 5 Hold a car purchase contract agreement approved by the handling bank.

2. Current requirements for bank car loans: age requirements: applicants must be at least 18 years old, men must not be over 65 years old, and women must not be over 60 years old. Job requirements: At present, the applicant has a stable job and income, and the monthly repayment amount of the car loan cannot exceed 50% of the monthly income.

3. Bank of China's personal consumer car loan application materials: loan application (need to include the borrower's name, address and valid contact information and other information). The borrower's valid identity proof materials, married customers need to provide spouse's identity proof materials and marital status proof materials at the same time. Borrower's income/asset certification materials.

4. (5) The car buyer is willing to accept other conditions that the bank deems necessary.

5. Certificate of ability to pay the first purchase of the limit stipulated in these measures; other conditions stipulated by the bank.

CCB's interest rate is 6% per year, and the interest rate for one to five years is 0%. The monthly payment calculation is your loan amount divided by the loan term, and the term is yes Calculated by month.

CCB car mortgage loan interest rate CCB car loan interest rate is as follows: 1. The interest rate on car loans of one year or less is 6%, and the interest rate of car loans of more than one year but not more than five years is 6%; calculate once. If the applicant chooses to borrow for three years, the loan amount is 150,000 yuan.

The current benchmark interest rate for commercial loans is 35% within one year, 75% for one to five years, and 9% for more than five years.

It is understood that the three-year interest rate of the Construction Bank's car loan is normal during this period. The interest is closely related to the loan amount. Interest = the annual interest rate of the loan amount is 3. The overall loan interest rate is mainly subject to the provisions of the Construction Bank's loan interest rate.

The loan interest rate of car loans is generally between 5% and 3%. The following is a relevant introduction to the car loan interest rates of each bank: Bank of China: the loan term is 1 year, the loan interest rate is 4%, the loan interest rate is 8% for 2 years, and the interest rate is 12% for 3 years.

If you apply for a medium- and long-term loan in CCB, the loan interest rate is 75% for three to five years (including five years). Most people go to CCB to apply for a car loan, and the maximum repayment period can only be three years. That is to say, if the user goes to CCB to apply for a car loan, the loan interest rate is about 35%-75%.

Basic banks can apply for car mortgages, such as Bank of China, Industrial and Commercial Bank of China, etc., but the relative mortgage is different.

Which bank can make car mortgages? At present, Agricultural Bank of China, China Construction Bank, Industrial and Commercial Bank of China, etc. can make car mortgages. Take the Agricultural Bank of China as an example, the specific conditions for its processing are: the applicant must be between 18 (inclusive) and 60 (inclusive) years old and have full civil capacity.

Every bank can apply for car mortgages, of course, including CCB, Agricultural Bank of China, Bank of China, etc., but when different banks use cars for mortgages, the conditions for application or mortgage are different.Let's talk about the car mortgage of Shanghai Bank as a case.

Cross-verifying suppliers by HS code

author: 2024-12-24 02:03End-to-end supplier lifecycle management

author: 2024-12-24 01:32US-China trade data comparisons

author: 2024-12-24 00:40Industrial lubricants HS code classification

author: 2024-12-24 00:14HS code-based cost modeling for imports

author: 2024-12-23 23:50How to secure international sourcing

author: 2024-12-24 02:02Exotic wood imports HS code references

author: 2024-12-24 01:30Global trade intelligence for banking

author: 2024-12-23 23:58HS code electrical machinery data

author: 2024-12-23 23:42HS code-driven customs clearance SLAs

author: 2024-12-23 23:36 How to access historical shipment records

How to access historical shipment records

385.17MB

Check Packaging industry HS code references

Packaging industry HS code references

612.32MB

Check HS code verification for exporters

HS code verification for exporters

115.29MB

Check Real-time HS code data integration

Real-time HS code data integration

286.79MB

Check International freight rate analysis

International freight rate analysis

548.11MB

Check Real-time freight cost analysis

Real-time freight cost analysis

573.47MB

Check HS code-driven compliance workflows

HS code-driven compliance workflows

327.14MB

Check Medical PPE HS code verification

Medical PPE HS code verification

546.68MB

Check HS code-based inbound logistics optimization

HS code-based inbound logistics optimization

841.65MB

Check HVAC equipment HS code mapping

HVAC equipment HS code mapping

655.28MB

Check HS code advisory for inbound compliance

HS code advisory for inbound compliance

592.65MB

Check HS code verification for exporters

HS code verification for exporters

984.45MB

Check Mineral ores HS code tariff details

Mineral ores HS code tariff details

119.23MB

Check Global trade shipping route optimization

Global trade shipping route optimization

576.59MB

Check HS code-driven customs risk scoring

HS code-driven customs risk scoring

771.13MB

Check Global trade reporting frameworks

Global trade reporting frameworks

188.34MB

Check How to benchmark HS code usage

How to benchmark HS code usage

574.15MB

Check HS code-based global benchmarking

HS code-based global benchmarking

984.16MB

Check Segmenting data by HS code and region

Segmenting data by HS code and region

169.98MB

Check Dehydrated vegetables HS code references

Dehydrated vegetables HS code references

369.11MB

Check Global trade route simulation

Global trade route simulation

822.61MB

Check HS code alignment with labeling standards

HS code alignment with labeling standards

325.94MB

Check Global trade forecasting tools

Global trade forecasting tools

815.33MB

Check How to integrate trade data into workflows

How to integrate trade data into workflows

951.11MB

Check USA trade data analysis

USA trade data analysis

412.24MB

Check Trade compliance automation tools

Trade compliance automation tools

786.52MB

Check Import export compliance audits

Import export compliance audits

337.26MB

Check HS code compliance training for logistics teams

HS code compliance training for logistics teams

754.73MB

Check Industry-focused HS code reporting

Industry-focused HS code reporting

736.32MB

Check How to utilize trade data in M&A

How to utilize trade data in M&A

221.71MB

Check trade data analysis

trade data analysis

664.72MB

Check Automated trade documentation tools

Automated trade documentation tools

712.38MB

Check Ready-to-eat meals HS code classification

Ready-to-eat meals HS code classification

181.32MB

Check Trade finance data solutions

Trade finance data solutions

773.29MB

Check Global trade data-driven asset utilization

Global trade data-driven asset utilization

616.41MB

Check Organic produce HS code verification

Organic produce HS code verification

697.25MB

Check

Scan to install

How to access historical shipment records to discover more

Netizen comments More

2716 Organic textiles HS code verification

2024-12-24 01:37 recommend

2639 Electronics global shipment tracking

2024-12-24 01:19 recommend

2018 Global trade data for PESTEL analysis

2024-12-24 00:43 recommend

398 Africa customs data solutions

2024-12-24 00:29 recommend

554 How to track non-compliance incidents

2024-12-24 00:22 recommend